Albemarle County Personal Property Tax Rate . Web the real property tax rate will remain at $0.854 per $100 of assessed value and the public notice will contain the. The albemarle county department of finance. Web albemarle county’s board of supervisors approved its fiscal year 2025 budget. Web the proposed fiscal year 2023 budget also includes a recommended personal property tax rate of $3.42 per $100 of assessed value, a decrease of 86. All qualifying vehicles in the county automatically receive personal property. Web on wednesday, the board voted unanimously to advertise its real estate tax rate as $0.854 per $100 of assessed. Web personal property tax relief act of 1998. This site is for payment of real and personal property tax. Web tax search & pay. $0.854 per $100 assessed value

from www.vrogue.co

Web on wednesday, the board voted unanimously to advertise its real estate tax rate as $0.854 per $100 of assessed. Web albemarle county’s board of supervisors approved its fiscal year 2025 budget. Web the proposed fiscal year 2023 budget also includes a recommended personal property tax rate of $3.42 per $100 of assessed value, a decrease of 86. Web personal property tax relief act of 1998. $0.854 per $100 assessed value This site is for payment of real and personal property tax. Web tax search & pay. All qualifying vehicles in the county automatically receive personal property. The albemarle county department of finance. Web the real property tax rate will remain at $0.854 per $100 of assessed value and the public notice will contain the.

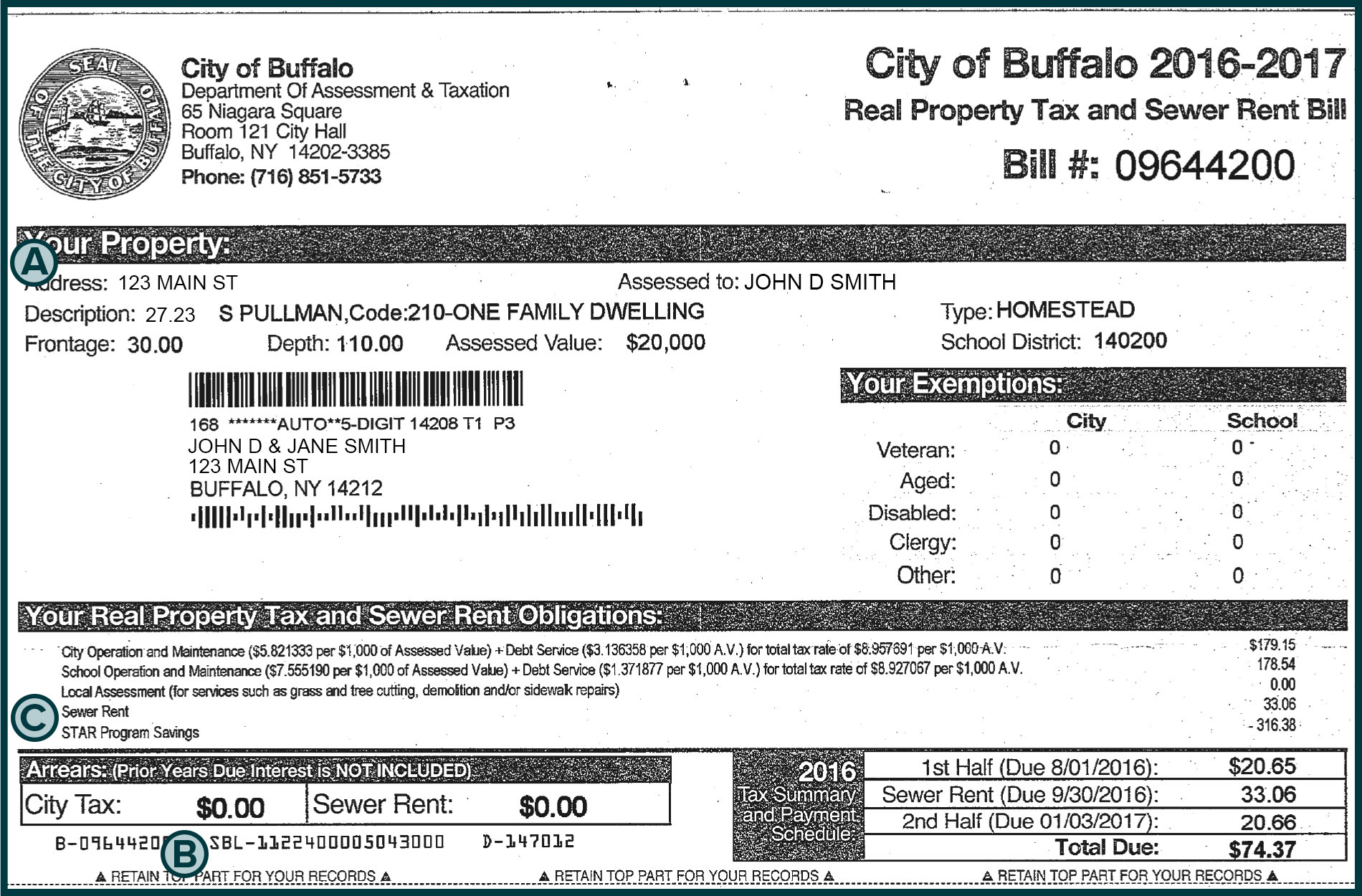

How To Read Your Property Tax Bill Property Walls vrogue.co

Albemarle County Personal Property Tax Rate Web tax search & pay. Web the proposed fiscal year 2023 budget also includes a recommended personal property tax rate of $3.42 per $100 of assessed value, a decrease of 86. This site is for payment of real and personal property tax. Web the real property tax rate will remain at $0.854 per $100 of assessed value and the public notice will contain the. Web tax search & pay. The albemarle county department of finance. $0.854 per $100 assessed value Web albemarle county’s board of supervisors approved its fiscal year 2025 budget. Web personal property tax relief act of 1998. Web on wednesday, the board voted unanimously to advertise its real estate tax rate as $0.854 per $100 of assessed. All qualifying vehicles in the county automatically receive personal property.

From ilyssakathleen.pages.dev

Mn Property Tax Dates 2024 Bobbi Chrissy Albemarle County Personal Property Tax Rate Web the proposed fiscal year 2023 budget also includes a recommended personal property tax rate of $3.42 per $100 of assessed value, a decrease of 86. Web albemarle county’s board of supervisors approved its fiscal year 2025 budget. Web personal property tax relief act of 1998. Web the real property tax rate will remain at $0.854 per $100 of assessed. Albemarle County Personal Property Tax Rate.

From propertytaxgov.com

Property Tax St. Louis 2023 Albemarle County Personal Property Tax Rate This site is for payment of real and personal property tax. Web the proposed fiscal year 2023 budget also includes a recommended personal property tax rate of $3.42 per $100 of assessed value, a decrease of 86. The albemarle county department of finance. Web personal property tax relief act of 1998. Web albemarle county’s board of supervisors approved its fiscal. Albemarle County Personal Property Tax Rate.

From dailyprogress.com

Albemarle to advertise same real estate tax rate, lower personal Albemarle County Personal Property Tax Rate Web albemarle county’s board of supervisors approved its fiscal year 2025 budget. This site is for payment of real and personal property tax. Web personal property tax relief act of 1998. The albemarle county department of finance. $0.854 per $100 assessed value Web the real property tax rate will remain at $0.854 per $100 of assessed value and the public. Albemarle County Personal Property Tax Rate.

From printablecampuspiper.z13.web.core.windows.net

Property Tax Information For Taxes Albemarle County Personal Property Tax Rate Web the real property tax rate will remain at $0.854 per $100 of assessed value and the public notice will contain the. This site is for payment of real and personal property tax. Web tax search & pay. Web on wednesday, the board voted unanimously to advertise its real estate tax rate as $0.854 per $100 of assessed. All qualifying. Albemarle County Personal Property Tax Rate.

From libbyqroxanna.pages.dev

When Does Taxes Release 2024 Tami Zorina Albemarle County Personal Property Tax Rate All qualifying vehicles in the county automatically receive personal property. Web personal property tax relief act of 1998. Web tax search & pay. Web albemarle county’s board of supervisors approved its fiscal year 2025 budget. Web the proposed fiscal year 2023 budget also includes a recommended personal property tax rate of $3.42 per $100 of assessed value, a decrease of. Albemarle County Personal Property Tax Rate.

From www.vrogue.co

How To Read Your Property Tax Bill Property Walls vrogue.co Albemarle County Personal Property Tax Rate Web tax search & pay. Web the proposed fiscal year 2023 budget also includes a recommended personal property tax rate of $3.42 per $100 of assessed value, a decrease of 86. All qualifying vehicles in the county automatically receive personal property. $0.854 per $100 assessed value Web personal property tax relief act of 1998. Web albemarle county’s board of supervisors. Albemarle County Personal Property Tax Rate.

From propertybsi.blogspot.com

Waynesboro Va Personal Property Tax PROPERTY BSI Albemarle County Personal Property Tax Rate All qualifying vehicles in the county automatically receive personal property. Web albemarle county’s board of supervisors approved its fiscal year 2025 budget. Web on wednesday, the board voted unanimously to advertise its real estate tax rate as $0.854 per $100 of assessed. The albemarle county department of finance. Web the real property tax rate will remain at $0.854 per $100. Albemarle County Personal Property Tax Rate.

From hikinginmap.blogspot.com

Map Of Albemarle County Va Hiking In Map Albemarle County Personal Property Tax Rate This site is for payment of real and personal property tax. All qualifying vehicles in the county automatically receive personal property. Web personal property tax relief act of 1998. Web on wednesday, the board voted unanimously to advertise its real estate tax rate as $0.854 per $100 of assessed. $0.854 per $100 assessed value Web the real property tax rate. Albemarle County Personal Property Tax Rate.

From tatumqamandie.pages.dev

States With Highest Property Tax 2024 Edin Doralynne Albemarle County Personal Property Tax Rate The albemarle county department of finance. All qualifying vehicles in the county automatically receive personal property. This site is for payment of real and personal property tax. Web on wednesday, the board voted unanimously to advertise its real estate tax rate as $0.854 per $100 of assessed. Web tax search & pay. Web albemarle county’s board of supervisors approved its. Albemarle County Personal Property Tax Rate.

From thomasinewjosee.pages.dev

Albemarle County Real Estate Tax Rate 2024 Randi Carolynn Albemarle County Personal Property Tax Rate All qualifying vehicles in the county automatically receive personal property. Web tax search & pay. Web the real property tax rate will remain at $0.854 per $100 of assessed value and the public notice will contain the. Web on wednesday, the board voted unanimously to advertise its real estate tax rate as $0.854 per $100 of assessed. Web personal property. Albemarle County Personal Property Tax Rate.

From kathleenshillxo.blob.core.windows.net

Property Taxes For Winchester Ca Albemarle County Personal Property Tax Rate This site is for payment of real and personal property tax. Web albemarle county’s board of supervisors approved its fiscal year 2025 budget. All qualifying vehicles in the county automatically receive personal property. Web tax search & pay. Web personal property tax relief act of 1998. Web on wednesday, the board voted unanimously to advertise its real estate tax rate. Albemarle County Personal Property Tax Rate.

From infocville.com

Albemarle Supervisors agree to advertise increases in personal property Albemarle County Personal Property Tax Rate All qualifying vehicles in the county automatically receive personal property. Web the proposed fiscal year 2023 budget also includes a recommended personal property tax rate of $3.42 per $100 of assessed value, a decrease of 86. Web personal property tax relief act of 1998. This site is for payment of real and personal property tax. $0.854 per $100 assessed value. Albemarle County Personal Property Tax Rate.

From citiesandtownsmap.blogspot.com

Albemarle County Virginia Map Cities And Towns Map Albemarle County Personal Property Tax Rate Web the proposed fiscal year 2023 budget also includes a recommended personal property tax rate of $3.42 per $100 of assessed value, a decrease of 86. Web personal property tax relief act of 1998. Web tax search & pay. $0.854 per $100 assessed value Web on wednesday, the board voted unanimously to advertise its real estate tax rate as $0.854. Albemarle County Personal Property Tax Rate.

From taxfoundation.org

Tangible Personal Property State Tangible Personal Property Taxes Albemarle County Personal Property Tax Rate The albemarle county department of finance. All qualifying vehicles in the county automatically receive personal property. Web albemarle county’s board of supervisors approved its fiscal year 2025 budget. Web the proposed fiscal year 2023 budget also includes a recommended personal property tax rate of $3.42 per $100 of assessed value, a decrease of 86. Web tax search & pay. Web. Albemarle County Personal Property Tax Rate.